The Loan Outlook: Take steps to ease the lending process

The National Association of Government Guaranteed Lenders (NAGGL) recently hosted its annual conference, drawing attention to critical trends in the SBA lending landscape. While the figures for 2024 SBA loans overall painted a positive picture—nearly $29 billion in loans extended to 66,000 borrowers—the outlook for 2025 is uncertain, particularly for franchises.

The lending environment is confusing, and many franchisees will find loans become expensive and difficult to get. This shift is driven by several factors, including lowering interest rates, rising default rates, increased operational costs, and evolving SBA policies. For franchisors, navigating these challenges will require a proactive approach to supporting franchisees in securing the capital they need to weather the storm.

Tough lending climate

One of the key challenges facing SBA lenders is the dramatic increase in early loan default rates. Over the past 18 months, these defaults have surged by an alarming 213%. For franchise businesses, the situation is compounded by economic pressures. According to the International Franchise Association’s (IFA) Annual Franchisee Survey, 80% of franchisees reported lower earnings in 2024 compared to previous years. Rising costs, persistent labor shortages, and weakening consumer demand have created a perfect storm for closures and financial strain.

Adding to the complexity, the SBA eliminated the Franchise Directory in May 2023, placing the onus on lenders to independently review franchise agreements and Rollover as Business Startups (ROBS) documents. This policy shift has introduced confusion and additional workload and costs for lenders and franchisors alike. Lenders are no longer required to report loans for franchises separately, meaning that the SBA franchise loan data, which has never been very accurate, cannot be used for risk rating at all anymore.

Proactive steps

Given these challenges, franchisors must take action to ensure their franchisees have access to financing. Here are some key steps:

- Provide comprehensive and updated documentation. Lenders rely on accurate and up-to-date FDDs to assess the viability of franchise loans. It’s critical for franchisors to provide detailed, clear, and current FDDs. Pay special attention to the inclusion of useful Item 19, which outlines financial performance representations. These figures play a vital role in helping lenders evaluate potential risks and returns, so they must be as transparent and robust as possible.

- Leverage the Franchise Registry. Nearly 75% of SBA franchise loans are issued by the top 56 lenders. Many of these institutions depend on the Franchise Registry for reliable information about franchise eligibility and credit risk. To maximize your franchise’s appeal to lenders, ensure that the Franchise Registry has your updated FDD and the latest system numbers for your brand. This small step can go a long way in streamlining the loan evaluation process.

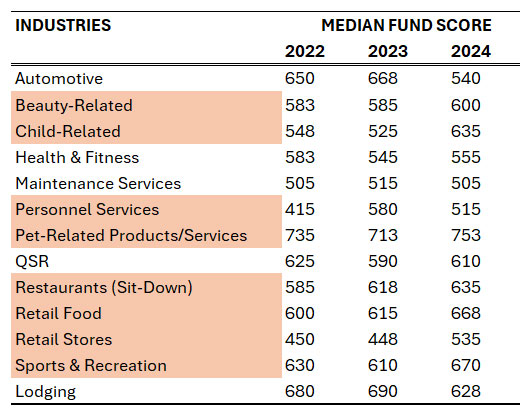

- Understand and address your FUND score. In lieu of good SBA data, the FUND score, a benchmark of a franchise’s financial health and performance, is a critical metric for lenders in determining loan eligibility. Alarmingly, for five of the 13 major franchise industries, the median FUND score per brand falls below the threshold acceptable to most lenders. If your brand is struggling to meet these benchmarks, it’s essential to act. A bank credit report, which provides lenders with additional reassurance about your franchise’s financial stability, can be a valuable tool. This report can help offset concerns and provide a clear picture of your brand’s resilience and potential.

An uncertain future

The economic environment in 2025 is expected to be turbulent. With franchisee performance trends on a downward trajectory and lenders becoming increasingly cautious, franchisors must take every possible step to ease the lending process for their franchisees.

As the landscape grows more challenging, staying ahead of these issues will help franchisees secure necessary funding and strengthen the brand’s overall reputation and resilience. Franchisors who take these steps will be better equipped to navigate the choppy waters of 2025 and beyond.

Paul Wilbur is COO of FRANdata where he is instrumental in building the company’s research and consulting framework. He manages the research, information management, marketing, and IT departments and plays an integral role in the strategic development of FRANdata’s suite of franchise solutions. Contact him at 703-740-4700.

Share this Feature

Recommended Reading:

| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Multi-Unit Franchisee Magazine: Issue 1, 2025

| ADVERTISE | SPONSORED CONTENT |

$250,000

$300,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.